Sidebar

Add this page to your book

Remove this page from your book

ASCENDER - End-of-Year (EOY) Accruals for June Year-End LEAs

Created: 05/10/2018

Reviewed: 06/02/2025

Revised: 06/02/2025

The purpose of this document is to guide you through the necessary steps to address June year-end payroll accruals to ensure that amounts are balanced in accrual accounts for end-of-year purposes.

The steps listed in this document should be completed prior to running the June payroll. Review each step and address it as needed.

This document assumes that you are familiar with the basic features of the ASCENDER Business System and have reviewed the ASCENDER Business Overview guide.

Some of the images and/or examples provided in this document are for informational purposes only and may not completely represent your LEA’s process.

Before You Begin

Review the following information and/or complete the following steps before you begin the End-of-Year (EOY) Accruals for June Year-End LEAs process.

❏ Review the EOY Flowchart for July Start LEAs.

❏ Review the Accrual Overview.

EOY Accruals for June Year-End LEAs Process

- Run the payroll accrual variance extract.

Run the payroll accrual variance extract

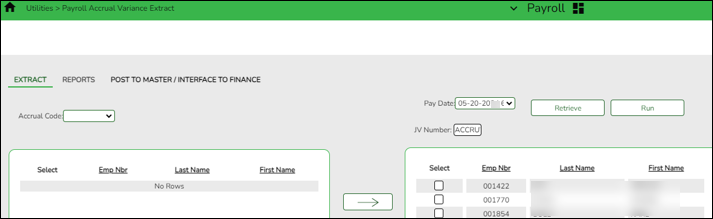

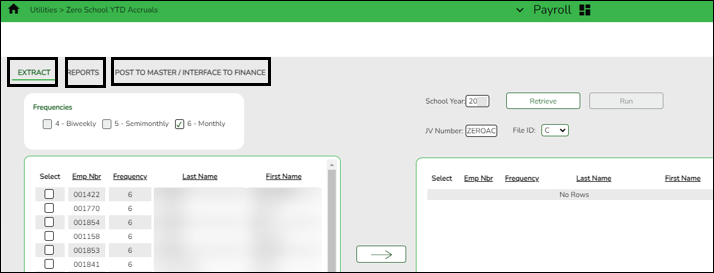

Payroll > Utilities > Payroll Accrual Variance Extract > Extract

Review the Accrual Overview document for more information about the Payroll Accrual Variance Extract process steps.

It is recommended to balance accruals monthly to help identify and correct any errors. Use the Payroll > Utilities > Payroll Accrual Variance Extract > Extract to assist you in this process.

- Use the Extract tab to run the extract and extract payroll accrual variances.

- Use the Reports tab to review and verify any extracted payroll variances.

- Use the Post To Master/Interface To Finance tab to post valid variances and interface to Finance if needed.

- Generate a user-created report.

Generate a user-created report

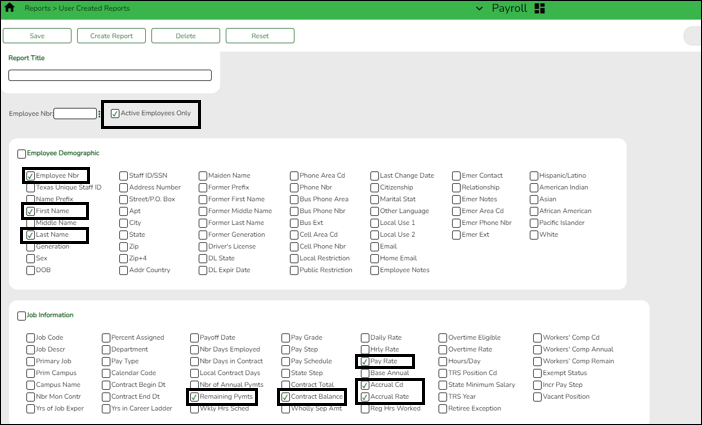

Payroll > Reports > User Created Reports

Use the following parameters to generate a user-created report:

- Active Employees Only

- Employee Nbr

- First Name

- Last Name

- Remaining Payments

- Contract Balance

- Pay Rate

- Accrual Code

- Accrual Rate

Save the report in Excel to allow data to be manipulated. - Perform Excel file maintenance.

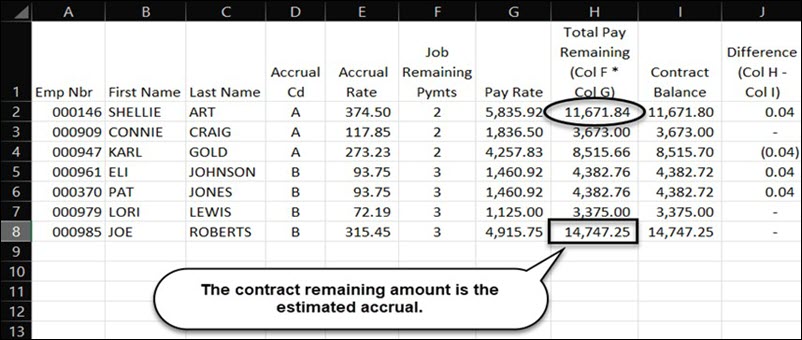

Perform Excel file maintenance

Modify the Excel file.

- Sort the file by Accrual Cd, and then by Last Name.

- Arrange the order of columns as follows: Employee Nbr, First Name, Last Name, Accrual Code, Accrual Rate, Remaining Payments, Pay Rate, and Contract Balance

- Insert a new column (Total Pay Remaining) between the Pay Rate and the Contract Balance columns. And, then in this column (Column H), insert the following formula: Job Remaining Payments (column F) x Pay Rate (column G)

- In Column J, insert the calculation for the Difference with the following formula: Total Pay Remaining (column H) - Contract Balance (column I)

- Generate the HRS3050 report for inactive employees.

Generate the HRS3050 report for inactive employees

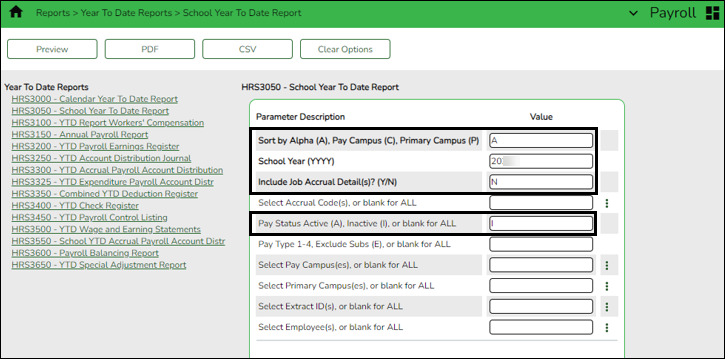

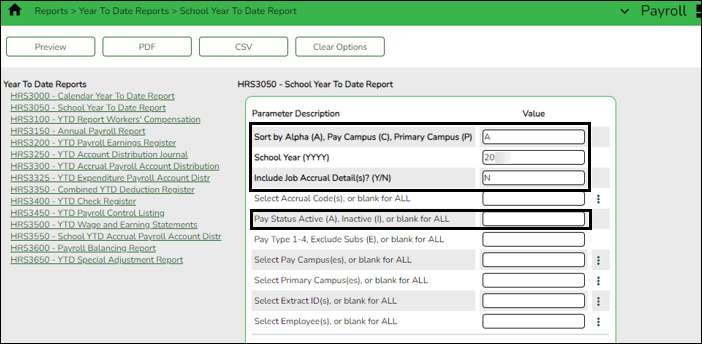

Payroll > Reports > Year to Date Reports > HRS3050 - School Year To Date Report

Generate the report with the following parameters. Print and/or save this report and review it for accuracy.

If there are any individuals with an accrual balance displayed on this report who are no longer with the LEA, perform the Payroll > Utilities > Zero School YTD Accruals to zero out their accruals.

Generate the report again with the following parameters. Print and/or save this report and review it for accuracy.

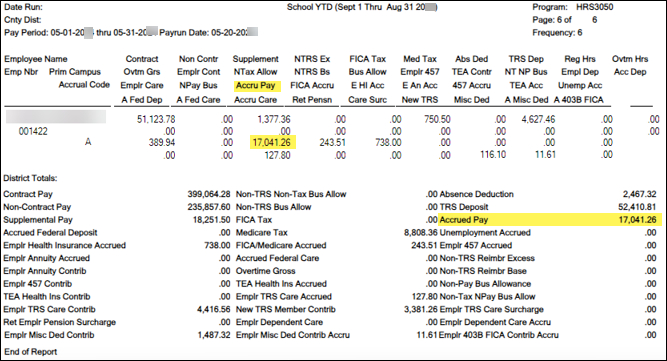

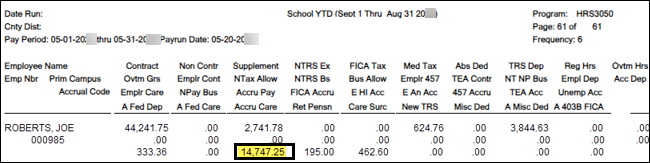

Compare the Accrued Pay totals to the Total Pay Remaining column from Step 3.

Note: The Accrued Pay should match the Total Pay Remaining (column H) in the Excel file.

- Verify the differences and correct any issues.

Verify and correct issues

Verify the differences and correct any problems with the staff accrual payroll information so that the amounts are the same. You may have to:

Use the Payroll > Tables > Accrual Calendars > Accrual Calendar page to:

- Build an accrual calendar for individuals who did not have one built at the beginning of the year.

- Correct the number of days worked in the accrual calendar.

Use the Payroll > Maintenance > Staff Job/Pay Data > Job Info tab to:- Enter an accrual code for individuals who do not have one.

- Enter an accrual rate for individuals who do not have one.

- Correct the accrual rate (should be the same as the daily rate) for individuals.

Then, use the Payroll > Utilities > Payroll Accrual Variance Extract to perform the following steps:

- Use the Extract tab to run the accrual variance again.

- Use the Reports tab to review and verify any differences between the spreadsheet and the variance report.

- Correct any issues as needed.

- Use the Post To Master/Interface To Finance tab to post valid variances and interface to Finance if needed.

Generate the Payroll > Reports > Year to Date Reports > HRS3050 - School Year To Date Report again from Step 4 and verify that it matches the estimate from Step 3. - Generate the HRS3550 - School YTD Accrual Payroll Account Distribution Report.

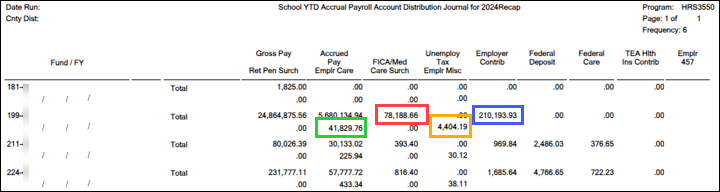

Generate the HRS3550 Report

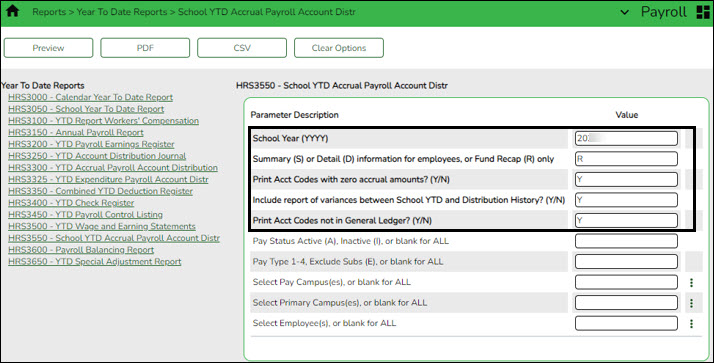

Payroll > Reports > Year To Date Reports > HRS3550 - School YTD Accrual Payroll Account Distr

After the estimate from the Excel file (Step 3) and the HRS3050 report (Step 4) match, generate the report with the following parameters:

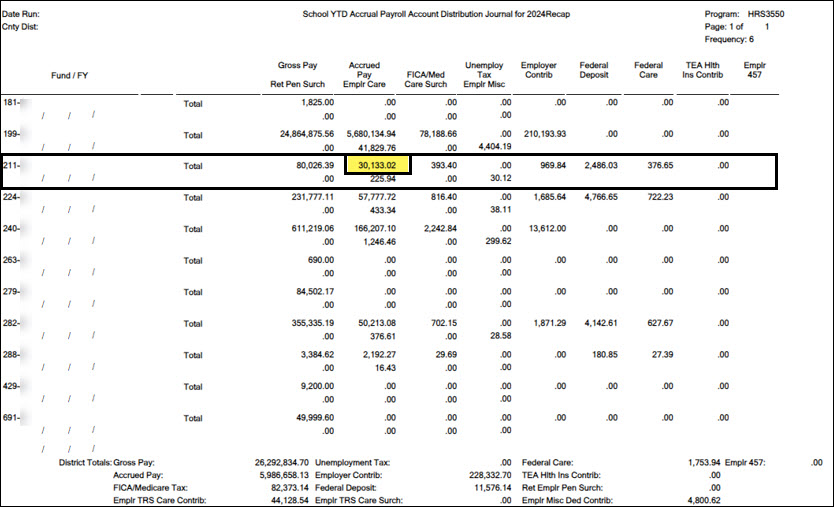

This report will assist you as you balance to Finance in the following step.

- Run a general ledger inquiry.

Run a general ledger inquiry

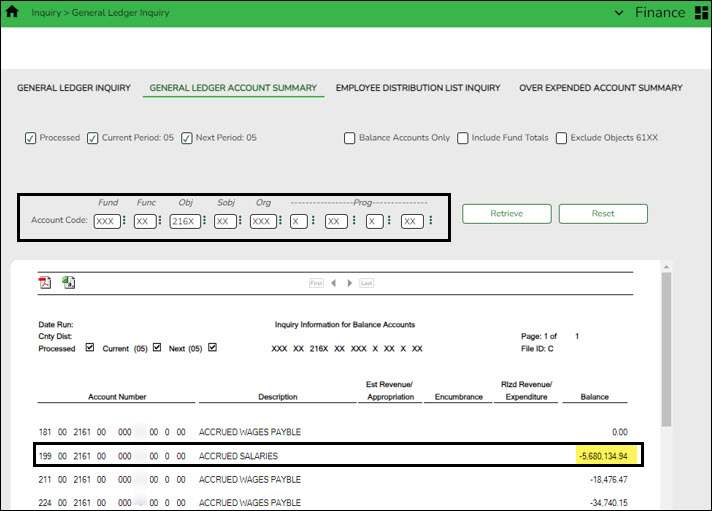

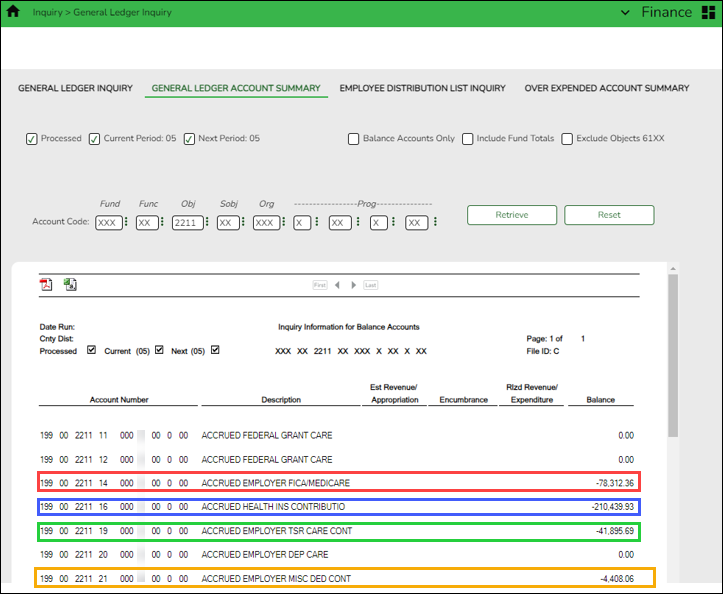

Finance > Inquiry > General Ledger Inquiry > General Ledger Account Summary

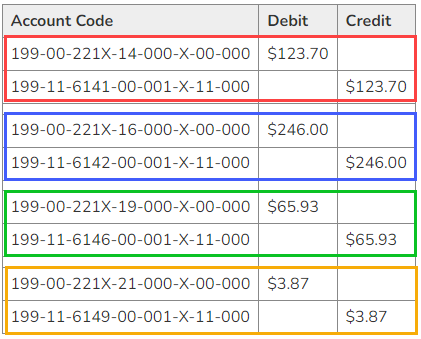

When considering potential journal entries to be made later in this step, use the following chart for reference.

Note: This chart derives from the Payroll Automatic Posting Default section on the Finance > Tables > District Finance Options > Clearing Fund Maintenance tab.

General Ledger Inquiry Report School YTD Report Expenditure Object Code 216X Accrued Wages 6119 or 6129 221X.11 Accrued Federal Grant Deposit 6146 221X.12 Accrued Federal Grant Care 6146 221X.14 Accrued Employer FICA/Medicare 6141 221X.15 Accrued Employer Unemployment Tax 6145 221X.16 Accrued Health Insurance Contribution (Emplr Health Insurance Accrued + TEA Health Ins Accrued) 6142 221X.17 Accrued Employer 457 Contribution 6149 221X.18 Accrued Employer Annuity Contribution 6149 221X.19 Accrued Employer TRS Care Contribution 6146 221X.20 Accrued Employer Dependent Care 6149 221X.21 Accrued Employer Miscellaneous Deduction Contribution 6149 Run an inquiry on the 216X and 221X accounts from Finance and compare the balances to the Payroll > Reports > Year To Date Reports > HRS3550 - School YTD Accrual Payroll Account Distribution Journal.

This inquiry can also be run in Purchasing.

If there is a difference in any of the funds, a journal entry needs to be made to balance the general ledger to the HRS3550 - School YTD Accrual Payroll Account Distribution Journal.

Compare the HRS3550 report totals to the General Ledger Inquiry reports.

Review the following example entry:Account Code Debit Credit 199-00-2161-00-000-X-00-000 $2,696.98 199-11-6119-00-001-X-11-000 $2,696.98 This is the difference between the two amounts. The entry has to make the general ledger match the HRS3550 - School YTD Accrual Payroll Account Distribution Journal.

If there is a difference in any of the funds such as in the example shown below, a journal entry will need to be made to balance the general ledger to the HRS3550 - School YTD Accrual Payroll Account Distribution Journal.

Review the following example entry:Note: Be sure to keep a clean final copy of both of the HRS3550 reports for the auditor. These reports cannot be recreated after the July and August payrolls are processed.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.