User Tools

Sidebar

Add this page to your book

Remove this page from your book

This is an old revision of the document!

ASCENDER - Roll Balances Supplement

Created: 07/10/2020

Reviewed: 05/20/2022

Revised: 05/20/2022

The purpose of this document is to assist those LEAs that did not close revenues and expenditures and did not carry forward balance sheet account balances to the new fiscal year. This information will assist in posting the opening balance sheet amounts to file ID C.

After your auditor has made the audit entries to file ID 2, you have the option of closing the funds from file ID 2, and transferring the resulting balance sheet amounts to the current file ID for fiscal year 3. At that time, your Bank Reconciliation System Cash will reflect all cash amounts in the current file ID.

Note: If your auditor provides opening entries that you will enter in file ID C, DO NOT use this option.

This document assumes you are familiar with the basic features of the ASCENDER Business system and have reviewed the ASCENDER Business Overview guide.

Some of the images and/or examples provided in this document are for informational purposes only and may not completely represent your LEA’s process.

Roll Balances Supplement Process

- Perform an export.

Perform an export

Log on to file ID 5.

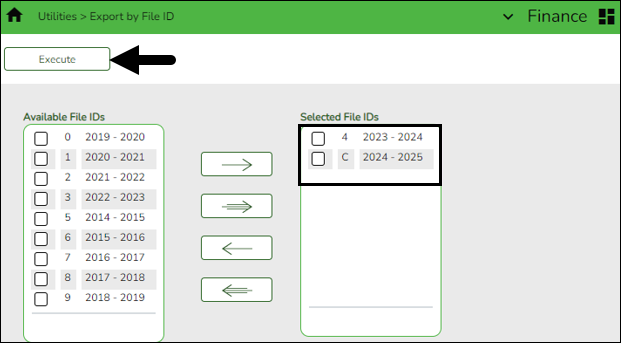

Finance > Utilities > Export by File ID

Perform an export prior for file IDs 5 and C.

❏ Select file IDs 5 and C and move to the right side of the page.

❏ Click Execute to execute the process. A message is displayed indicating that you are about to export Finance tables.

❏ Click Yes to continue. Otherwise, click No to return to the Export by File ID page.

- A pop-up window opens, in the Enter the Password to be used for the Archive, type a password for the file. You are prompted to enter a password for each export. Click OK.

- A dialog box opens with a preset File name, do not rename the file. Save the file on your computer or network. A message is displayed indicating that the Finance tables were successfully exported.

- Correct out-of-balances.

Correct out-of-balances

Log on to file ID 5.

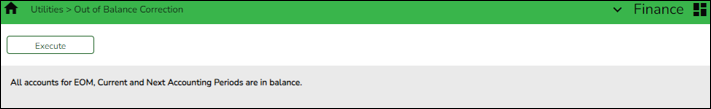

Finance > Utilities > Out of Balance Correction

After the opening balances have been posted in file ID 5, correct any out-of-balance occurrences. If there are no out-of-balance occurrences, continue to the next step.

This utility is designed to locate out-of-balance accounts in the End-of-Month (EOM), current, and next accounting periods.

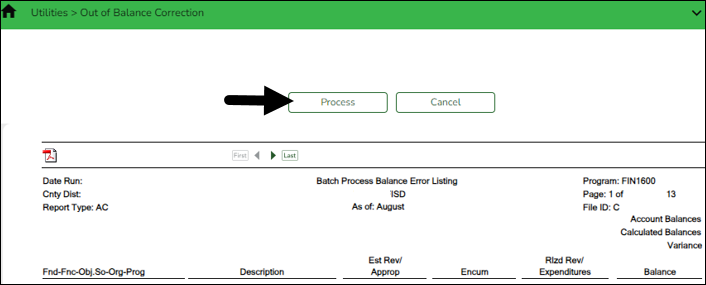

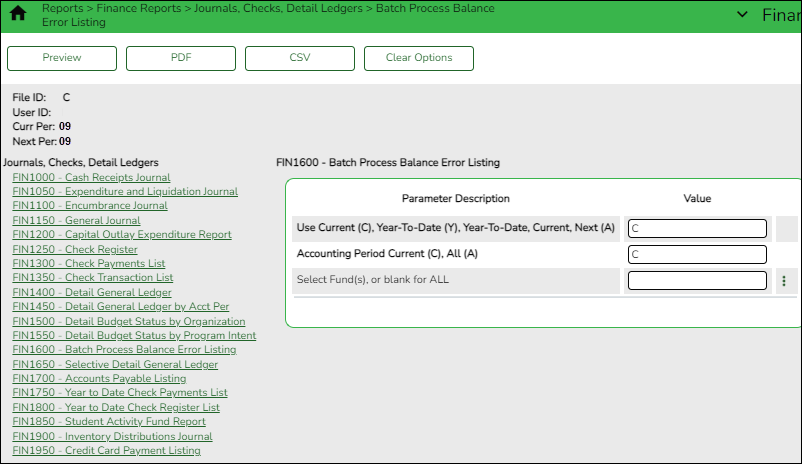

If out-of-balance accounts exist, the FIN1600 - Batch Process Balance Error Listing Report is displayed with a list of the accounts. These out-of-balance situations may have been inadvertently caused by the system (e.g., missed transactions in the End-of-Month (EOM)). After processing the utility, the totals are recalculated and corrected in the general ledger.

IMPORTANT: The utility will not correct a true out-of-balance entry where a Fund Total is displayed in the General Ledger; those still need to be submitted for correction.

The ASCENDER processing logo is displayed upon accessing the page indicating that the program is searching for any out-of-balance accounts in the EOM, current, and next accounting periods.

If all accounts are in balance, the following message is displayed: All accounts for EOM, Current and Next Accounting Periods are in balance.

If any out-of-balance accounts exist for YC, AC, AA, the FIN1600 - Batch Process Balance Error Listing Report is displayed with a list of the accounts. Review the report.

- Click Process to recalculate the totals and correct out-of-balances in the general ledger.

- Click Cancel to cancel the process.

A message is displayed indicating that the process was completed successfully.

- Carry forward end balance sheet account balances.

Carry forward end balance sheet account balances

Log on to file ID 5.

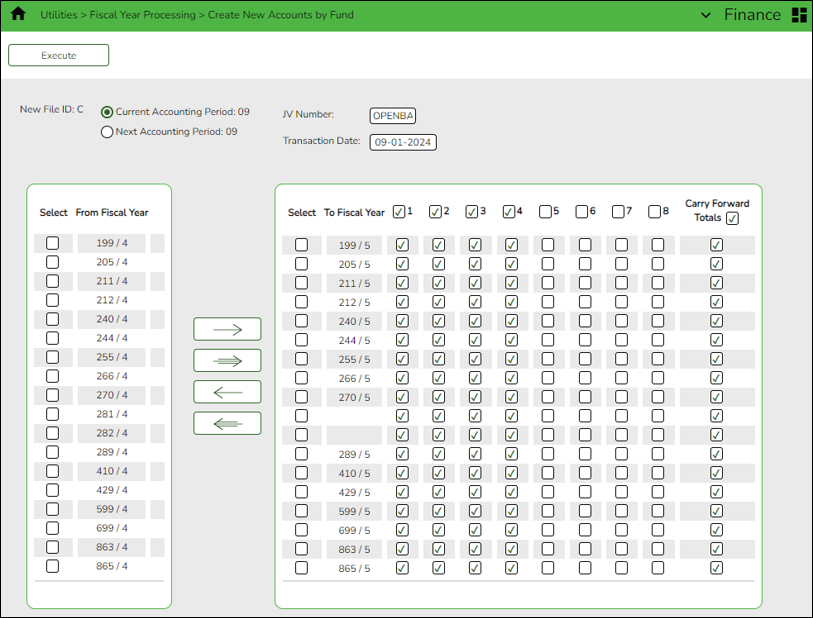

Finance > Utilities > Fiscal Year Processing > Create New Accounts by Fund

Skip this step if you prefer to manually enter opening entries.

Carry forward the ending balance sheet account balances from file ID 5 to file ID C. This step will copy the accounts and balances to file ID C. If the account already exists, it will not recreate the account but instead will add the amount to the balance that exists in the account for file ID C. The balancing entry for each fund, if needed, will be to the account whose object is the actual fund balance object code from the Fund tab in the Account Code table in file ID C. If a budgetary fund balance amount is transferred, the amount may need to be moved.

IMPORTANT: Keep in mind that you need to be aware of the funds that were Continued in the current file ID (as part of the EOY Finance process). You cannot carry forward balances for Continued funds.

❏ Select the appropriate accounting period.

❏ In the JV Number field, type OPENBA.

❏ In the Transaction Date field, type the transaction date.

❏ Use the arrow buttons to move the applicable funds to the right side of the page. The fiscal year should increment by one.

❏ Click Select Class.

❏ In the Select All field, select the following:- Class 1 – 1XXX = Assets, including cash

- Class 2 – 2XXX = Liabilities

- Class 3 – 3XXX = Fund balances

- Class 4 – 4XXX = Encumbrances

- Carry Forward Totals

❏ Click Execute. After you click Execute, the Create New Accounts By Fund Error Report may be displayed. Review the report and make corrections as needed. Repeat this step or click Continue.

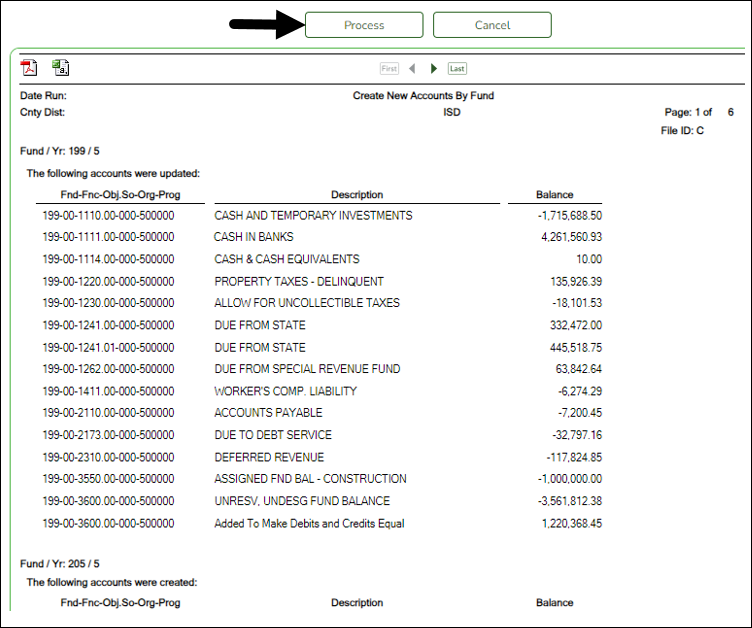

❏ Once you click Continue, a preview report is displayed. It is recommended that you print or save this report for your records.❏ Click Process to process the report. A message is displayed indicating that the process was successful.

- Print and review Finance reports.

Print and review Finance reports

Log on to file ID C.

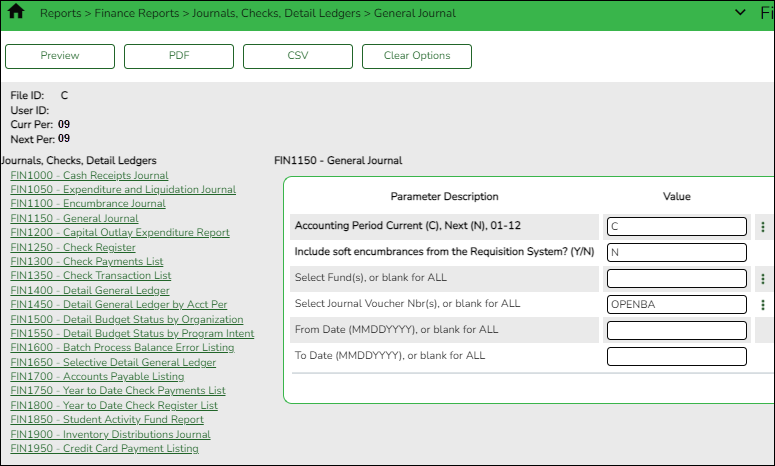

Finance > Reports > Finance Reports > Journals, Checks, Detail Ledgers > FIN1150 - General Journal

Generate this report with the JV number used in Step 3 to verify account balances. For example, this document used JV number OPENBA as seen in the following image.

Generate this report to verify account balances.

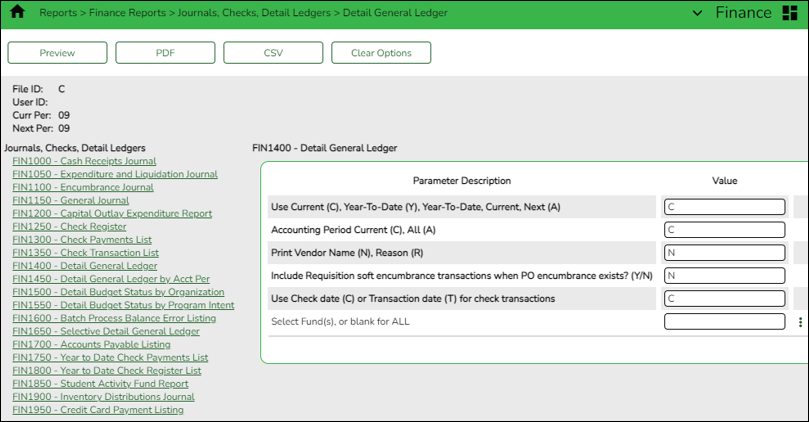

Generate this report to verify that there are no funds out of balance. The report should be blank.

- Correct out-of-balances.

Correct out-of-balances

Log on to file ID C.

Finance > Utilities > Out of Balance Correction

Use the Out of Balance Correction page to view and correct any out-of-balance occurrences after the opening balances have been posted in file ID C.

This utility is designed to locate out-of-balance accounts in the End-of-Month (EOM), current, and next accounting periods.

If out-of-balance accounts exist, the FIN1600 - Batch Process Balance Error Listing Report is displayed with a list of the accounts. These out-of-balance situations may have been inadvertently caused by the system (e.g., missed transactions in the End-of-Month (EOM)). After processing the utility, the totals are recalculated and corrected in the general ledger.

IMPORTANT: The utility will not correct a true out-of-balance entry where a Fund Total is displayed in the General Ledger; those still need to be submitted for correction.

The ASCENDER processing logo is displayed upon accessing the page indicating that the program is searching for any out-of-balance accounts in the EOM, current, and next accounting periods.

Perform out-of-balance inquiry or correction:

If all accounts are in balance, the following message is displayed: All accounts for EOM, Current and Next Accounting Periods are in balance.

❏ Click Execute to perform the out-of-balance inquiry again.

If any out-of-balance accounts exist for YC, AC, AA, the FIN1600 - Batch Process Balance Error Listing Report is displayed with a list of the accounts. Review the report.

- Click Process to recalculate the totals and correct out-of-balances in the general ledger.

- Click Cancel to cancel the process.

A message is displayed indicating that the process was completed successfully.

TIP: In the current file ID, verify that the correct fund balance amount is posted as an opening entry. These fund balance amounts should match your LEA’s Audit Report. Adjusting entries may need to be posted to balance these accounts.

Note: If you did not post auditor entries in file ID 2 before you rolled balances forward to file ID C, post auditor entries for FY2 in file ID 2 (for Mid-Yr PEIMS) and auditor adjusting entries for balance sheet accounts in file ID C.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.