User Tools

Sidebar

Add this page to your book

Remove this page from your book

Employee Guide: View Earnings & Tax Information

Welcome to ASCENDER EmployeePortal. This application provides you with access to various employee data inquiries and maintenance features.

EmployeePortal allows you to view your current and historical pay information including calendar year-to-date information, deductions, earnings, W-2 information, and 1095 information. You can view up to 18 months of check stub information.

Your local education agency (LEA) determines the pages and data fields that can be viewed and/or edited in EmployeePortal. If you have questions, contact your EmployeePortal administrator.

Before You Begin

Review the ASCENDER EmployeePortal Navigation page to familiarize yourself with the portal.

TIP: If you have any new notifications from EmployeePortal, the number of pending notifications is displayed in the top-right corner of the page on ![]() . Click

. Click ![]() to view the Notifications box. You can either click Mark All As Read to mark all notifications as read and clear all notifications or click a notification to open the Notifications page. From the Notifications page, you have the option to Mark All As Read or click

to view the Notifications box. You can either click Mark All As Read to mark all notifications as read and clear all notifications or click a notification to open the Notifications page. From the Notifications page, you have the option to Mark All As Read or click ![]() to clear each individual notification.

to clear each individual notification.

Use the Inquiry menu to perform various earnings and tax inquiries. Review the applicable online Help pages for information about specific fields.

I. View Earnings

W-4 Information Notes:

- If you have completed an updated W-4 form for the 2020 tax year or greater, then the seven W-4 Withholding Certificate (W4 Filing Status, W4 Multi-Jobs, W4 Children under 17, W4 Other Dependents, W4 Other Exemptions, W4 Other Income, and W4 Other Deductions) fields are populated as applicable.

- If you have not completed an updated W-4 form for the 2020 tax year or greater, then the W-4 Withholding Certificate fields do not apply to you, and the Marital Status and Number of Exemptions fields are populated as applicable.

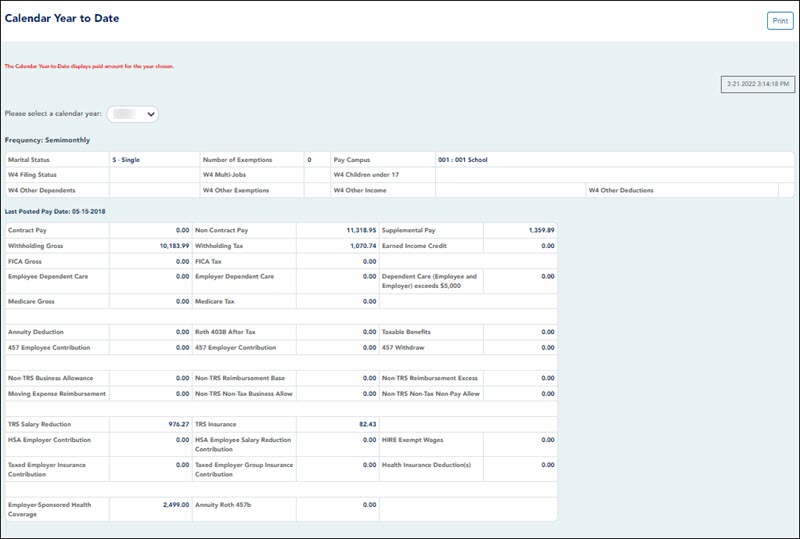

- Calendar Year to Date.

EmployeePortal > Inquiry > Calendar Year to DateThis page is used to view a year-to-date summary of various earnings information by payroll frequency. You can also view prior year information.

If this page is not enabled, check with your EmployeePortal administrator as the LEA may have opted to not allow access.

If a message is available from your LEA, it is displayed in red at the top of the page.

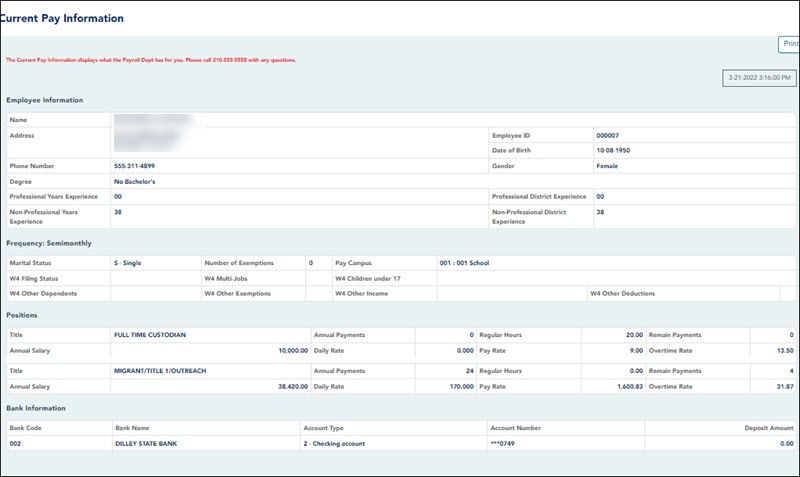

- Current Pay Information.

EmployeePortal > Inquiry > Current Pay InformationThis page is used to view your current pay information.

If you requested modifications such as changes to your withholding and exemptions, and those changes are not displayed, the LEA has yet to process the changes.

If this page is not enabled, check with your EmployeePortal administrator as the LEA may have opted to not allow access.

If a message is available from your LEA, it is displayed in red at the top of the page.

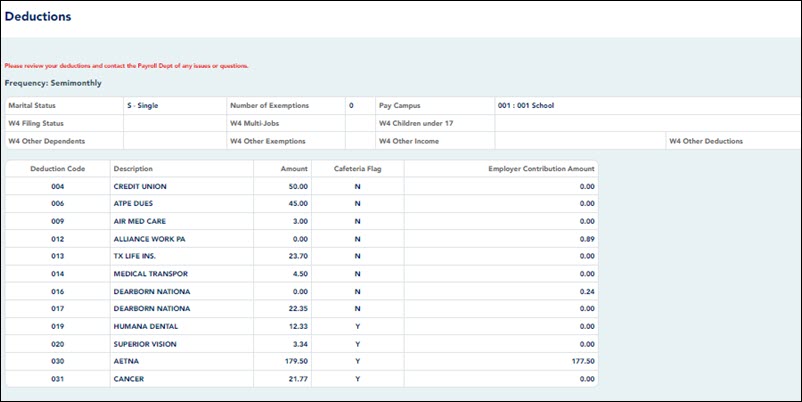

- Deductions.

EmployeePortal > Inquiry > DeductionsThis page is used to view your current payroll deduction information. If applicable, the employer's contributions to the deductions are also displayed in addition to your withholding status and the number of exemptions.

If you have requested modifications to your deductions and those changes are not displayed, the LEA has yet to process the changes.

If this page is not enabled, check with your EmployeePortal administrator as the LEA may have opted to not allow access.

If a message is available from your LEA, it is displayed in red at the top of the page.

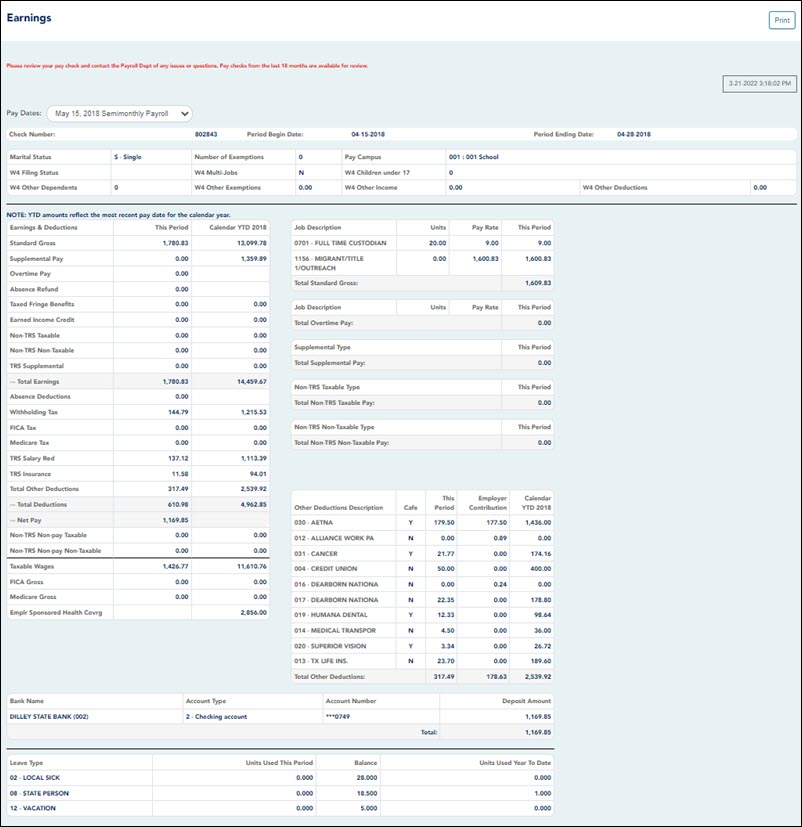

- Earnings.

EmployeePortal > Inquiry > EarningsThis page is used to view earnings and direct deposit information. The information is per pay date and frequency. You can view 18 months of earnings or the last 50 pay dates. If you are on multiple frequencies, the pay dates and associated frequency are displayed.

If this page is not enabled, check with your EmployeePortal administrator as the LEA may have opted to not allow access.

If a message is available from your LEA, it is displayed in red at the top of the page.

II. View Tax Information

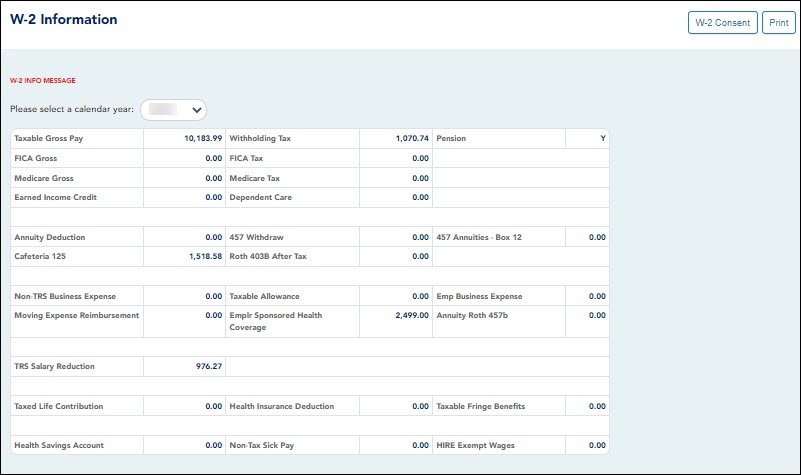

- W-2 Information.

EmployeePortal > Inquiry > W-2 InformationThis page is used to view your W-2 information. Additionally, you can indicate how you want to receive and access your W-2 form; electronically or printed, by mail. Previous year and frequency combinations are available for selection. Official W-2s can be printed from calendar year 2009 or greater. W-2s from years prior to 2009 can be viewed but not printed.

If this page is not enabled, check with your EmployeePortal administrator as the LEA may have opted to not allow access.

If a message is available from your LEA, it is displayed in red at the top of the page.

In addition, you can use this page to indicate your W-2 electronic consent preference. If you have not previously indicated your electronic consent preference, the W-2 Electronic Consent window opens when you access the W-2 Information page. You can change your electronic consent preference at any time.

❏ Click W-2 Consent. The W-2 Electronic Consent window opens with information about your consent.

The W-2 Consent button is only displayed if the option is enabled by the LEA or service center.

- Select Yes if you consent to electronic access of your W-2 form and agree to access your W-2 form electronically as described in the instructions, and print your own W-2 form. If selected, you will not receive a printed, mailed copy of your W-2 form.

- Select No to decline electronic consent and receive a printed, mailed copy of your W-2 form.

- Click Save to save your consent election. Otherwise, click Cancel to close the window without making a selection. If you do not make a selection, your W-2 form will be printed and mailed.

Notes:

- You can print a copy of your W-2 form regardless of your selected consent preference.

- You can change your consent preference at any time.

- You will receive an email message confirming your selected preference.

- The confirmation email is sent to the email address listed on your demographic record. The email is sent to either the work or home email address; whichever is available. If both are available, the email is sent to the work email address.

❏ Click Print to display a printable PDF version of your Form W-2 Wage and Tax Statement.

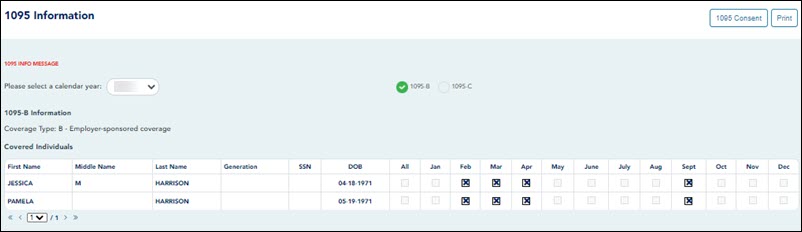

- 1095 Information.

EmployeePortal > Inquiry > 1095 InformationThis page is used to view your 1095 information. Additionally, you can indicate how you would like to receive and access your 1095 form; electronically or printed, by mail. Official 1095 forms can be printed and viewed from calendar year 2015 and greater.

If this page is not enabled, check with your EmployeePortal administrator as the LEA may have opted to not allow access.

If a message is available from your LEA, it is displayed in red at the top of the page.

In addition, you can use this page to indicate your 1095 electronic consent preference. If you have not previously indicated your electronic consent preference, the 1095 Electronic Consent window opens when you access the 1095 Information page. You can change your electronic consent preference at any time.

❏ Select 1095-B to display your 1095-B data for the selected calendar year.

OR

❏ Select 1095-C to display your 1095-C data for the selected calendar year.

❏ Click 1095 Consent. The 1095 Electronic Consent window opens with information about your consent.

The 1095 Consent button is only displayed if the option is enabled by the LEA.

- Select Yes if you consent to electronic access of your 1095 form and agree to access your 1095 form electronically as described in the instructions, and print your own 1095 form. If selected, you will not receive a printed, mailed copy of your 1095 form.

- Select No to decline electronic consent and receive a printed, mailed copy of your 1095 form.

- Click Save to save your consent election. Otherwise, click Cancel to close the window without making a selection. If you do not make a selection, your 1095 form will be printed and mailed.

Notes:

- You can print a copy of your 1095 form regardless of your selected consent preference.

- You can change your consent preference at any time.

- You will receive an email message confirming your selected preference.

- The confirmation email is sent to the email address listed on your demographic record. The email is sent to either the work or home email address; whichever is available. If both are available, the email is sent to the work email address.

❏ Click Print to display a printable PDF version of the Form 1095-B or 1095-C.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.