User Tools

Sidebar

Add this page to your book

Remove this page from your book

After the employee demographic record is created, use the following tabs to add job/pay data for the employee.

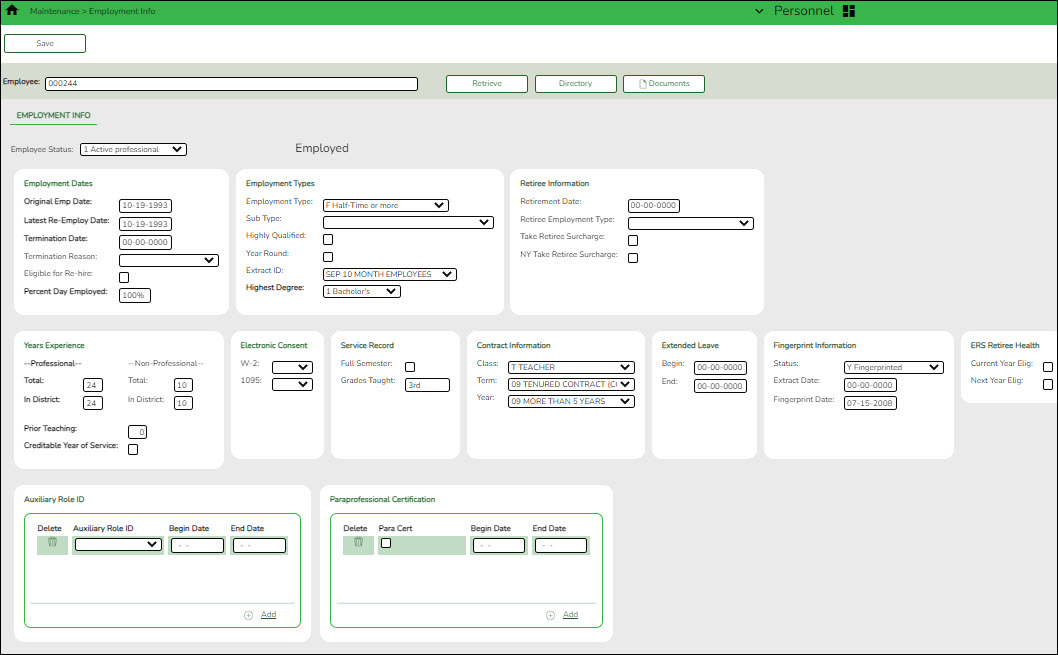

Employment Info

This tab is used to maintain basic employment information for an employee. The data includes employment dates, job assignments, contract information, and job termination dates. Before using this tab, each employee must have a demographic record.

Note: If an employee starts after the first day of their contract, then the employee start date will match the Begin Date under Calendar/Local Info on the Job Info tab.

Sample Staff Job/Pay Data Images by Pay Type (prints separately)

The following fields are required:

- Employee Status

- Highest Degree

- Percent Day Employed

- Original Employment Date (or Latest Re-Employ Date )

- Employment Type

Although all of the fields on this tab are not required, some of the fields are used for reporting to TEA, TRS, IRS, and SSA.

Complete the necessary employee information fields.

As you are making changes to employment dates, review the following examples for additional guidance on terminations, rehires, and change in positions:

Example 1: Termination Date

Employee A works for ABC LEA and leaves employment on 05/30/2025. Therefore, a termination date of 05/30/2025 must be entered. Later, Employee A returns to ABC LEA with a new start date of 08/12/2025. The original Termination Date of 05/30/2025 remains in place and the new start date should be entered in the Rehire Date field.

Example 2: Change in Position

Employee B is hired by ABC LEA as a paraprofessional with a hire date of 08/30/2025. Later, they obtain a teaching certificate and move into a teaching position starting 01/06/2026. In this case, the paraprofessional position should be ended and paid off on the Job Info record through 01/05/2026. The new teaching position should then be added with a beginning contract date of 01/06/2026. Note: The employee should not have a termination date or a rehire date since this is a change in position and not a separation from employment.

❏ Under Employment Dates:

| Original Emp. Date | Type the original date on which the individual was employed by the LEA in the MM-DD-YYYY format. This date does not change if the employee left the LEA and then returned. This field is required to extract the employee for State Reporting. Note: Employees are only included in the Instructor directory in Grade Reporting if they have an Original Emp. Date or Latest Re-Employ Date. If an employee does not have an employment date or if the employee has a termination date that is greater than their latest employment date, then the employee is not included in the Instructor directory. |

|---|---|

| Latest Re-Employ Date | Type the date the employee began his current period of employment in the MM-DD-YYYY format. The field applies only to employees who worked for the LEA, left the LEA, and then returned. If the employee never left the LEA, the field is left blank. |

| Termination Date | Type the date that the termination of the employee went into effect in the MM-DD-YYYY format. This field is used only for employees who have been terminated from their positions. When a date is entered in the Date field, the system deselects all remaining months for the year in the Unemployment Eligibility section, except for the actual termination month. The termination date and reason are used to exclude the employee from TEA reporting. |

| Extract for TSDS | Select to include the employee in TSDS Staff Domain extracts regardless of their employment status. This allows those individuals with a Not Employed status to be included in the TSDS extract process. This option is useful for job abandonment instances where a termination date must be entered. |

| Termination Reason | Click  to select the reason the employee was terminated. The termination reasons are maintained on the Personnel > Tables > Job/Contract > Termination Reason tab. to select the reason the employee was terminated. The termination reasons are maintained on the Personnel > Tables > Job/Contract > Termination Reason tab. |

| Eligible for Re-hire | Select if the employee is eligible for rehire. |

| Percent Day Employed | Type the percentage of a standard district (LEA) workday for which the employee is hired to work. This field is required. For an employee on contract, the percentage can be determined directly from the contract: full-time = 100, half-time = 050, and so on. For a non-contract employee, the percentage can be determined as follows. Example: The standard workday for the LEA is 7 hours. An employee is hired to work for 4 hours per day. This data element is coded as 057 for the employee because 4/7 = .571 is rounded down. Employees such as cafeteria workers and bus drivers who work only a few hours each day should not be reported as 100 in this field. Consider the number of hours worked in relation to the standard LEA workday, not the job. The field can be a maximum of three digits. |

| Pct Day Employed Effective Date | Type the employee's start date or the date they were hired. If the Percent Day Employed is changed, type the effective date of the change. This field only applies to employees with an Employee Status of 1, 2, 3, 4, 5, or A, and is only enabled when the Percent Day Employed is changed. If the Percent Day Employed is changed, the Pct Day Employed Effective Date is required. |

❏ Under Employment Types:

| Employment Type | |

|---|---|

| Sub Type | Click  to select the type of substitute teacher. This field is only displayed if the Pay Type field is set to 4 (Substitute) on the Job Info tab. to select the type of substitute teacher. This field is only displayed if the Pay Type field is set to 4 (Substitute) on the Job Info tab. |

| Highly Qualified | Select to indicate that the teacher is highly qualified. |

| Year Round | Select if the employee is employed on the year-round calendar. |

| Extract ID | Type a three-character, locally assigned code (e.g., 187 - 187-day employees, JUL - employees who start work in July, 12M - 12-month employees, etc.) for grouping employees, or click  to select an extract ID. These codes are used to group employees for mass updates. The extract ID information is maintained on the Personnel > Tables > Job/Contract > Extract ID tab. to select an extract ID. These codes are used to group employees for mass updates. The extract ID information is maintained on the Personnel > Tables > Job/Contract > Extract ID tab. |

| Highest Degree | Click  to select the highest degree the employee received from a certified learning institution. to select the highest degree the employee received from a certified learning institution.This field is required. |

❏ Under Retiree Information:

| Retirement Date | Type the employee's retirement date in the MM-DD-YYYY format. |

|---|---|

| Retiree Employment Type | |

| Take Retiree Surcharge | Select if the LEA should pay the TRS surcharges for retirees. When selected, the TRS retiree pension surcharge (based on gross pay) is calculated, and the TRS-Care surcharge (RI deduction code) is assessed during payroll calculations. Therefore, extreme care should be taken to make sure that the check box is set accurately for the process being performed. Retiree surcharges depend on retiree dates and vary based on the retiree; therefore, it is important to reference the TRS Reporting Entity Portal for specific details. |

| NY Take Retiree Surcharge | Select if the LEA should pay the TRS surcharges for retirees for next year processes. When selected, the TRS retiree pension surcharge (based on gross pay) is calculated, and the TRS-Care surcharge (RI deduction code) is assessed during the Interface NY Payroll to NY Budget extract. |

❏ Under Years Experience:

Professional column:

| Total | Type the total years of professional experience for the employee. The field can be a maximum of two digits. This information is included in the Teacher Service Record. |

|---|---|

| In District | Type the total years of professional experience for the employee in the LEA. The field can be a maximum of two digits. |

| Prior Teaching | Type the total number of years that the employee has previously held a teaching position in one or more educational institutions. |

| Creditable Year of Service | Select to indicate that the employee is a teacher who currently qualifies for the Teacher Incentive Allotment or has been submitted by the LEA for a new or change of designation, and has been employed by the LEA and compensated or will be compensated by the LEA for a creditable year of service. TEA defines a creditable year of service as 90 days at 100% of the day (equivalent to four and one-half months or a full semester) or 180 days required at 50-99% of the day and compensated for that employment. |

Non-Professional column:

| Total | Type the total years of non-professional experience for the employee. The field can be a maximum of two digits. |

|---|---|

| In District | Type the total years of non-professional experience for the employee in the LEA. The field can be a maximum of two digits. |

Note: When extracting teacher service records, the Years Experience fields are populated based on the TRS Member Pos field from the Job Info page, and the Years Experience fields from the Employment Info page. Refer to the Extract Teacher Service Record Checklist.

❏ Under Electronic Consent:

| W-2 |

Click

• If Yes is selected, the employee must log on to EmployeePortal to print the W-2. Note: Inactive employees can continue to view and print their W-2 information in EmployeePortal depending on the LEA. If the LEA opts to restrict inactive employee access (changes the EmployeePortal password or deletes the user's access), the employee will receive a printed, mailed copy of their W-2. |

|---|---|

| 1095 |

Click

If Yes is selected, the employee must log on to EmployeePortal to print the 1095. Note: Inactive employees can continue to view and print their 1095 information in EmployeePortal depending on the LEA. If the LEA opts to restrict inactive employee access (changes the EmployeePortal password or deletes the user's access), the employee will receive a printed, mailed copy of their 1095. |

❏ Under Service Record:

| Full Semester | Select if the employee worked a full semester that was less than 90 days. |

|---|---|

| Grade Taught | Type the grades the employee has taught (e.g., K-5). This information is included in the Teacher Service Record. |

❏ Under Contract Information:

The contract information is created and maintained on the Personnel > Tables > Job/Contract tabs.

❏ Under Extended Leave:

| Begin | Type the date on which the employee begins an extended leave of absence in the MM-DD-YYYY format. |

|---|---|

| End | Type the date on which the employee ends the extended leave of absence in the MM-DD-YYYY format. The end date cannot be prior to the begin date. |

❏ Under Fingerprint Information:

The Fingerprint fields are used only for tracking purposes.

❏ Under ERS Retiree Health:

| Current Year Elig | Select if the employee is an Employment Retirement System of Texas (ERS) retiree and is eligible to receive health coverage for the current year through ERS. If selected, the employee does not pay the Member Insurance Contribution (IN), and the employer does not pay the Reporting Entity TRS-Care payment (RI). |

|---|---|

| Next Year Elig | Select if the employee is an Employment Retirement System of Texas (ERS) retiree, and is eligible to receive health coverage for the next year through ERS. |

❏ Under TRA Years Experience:

| TRA Teaching Experience | Type the two-digit number of verifiable years of teaching experience as a classroom teacher as described in TEC §48.158. This field is required for teachers (Staff Classification 087), even if they only have 0–2 years and will not generate funding. The field default is zero. |

|---|---|

| TRA Eligibility | Select to indicate that the teacher works in an academic instructional setting for an average of at least four hours per day. Note: Staff are not required to hold a certificate but must meet the following criteria:

Responsibilities should be reported in either the Teaching and Learning Entity or the Staff Education Assignment Association Entity with a Staff Classification of 087, supporting the reported eligibility. For additional guidance, review the following:

|

❏ Under Auxiliary Role ID:

Notes:

The drop-down options are populated based on the year in the School Year for PEIMS Codes field on the Tables > District HR Options page.

This data is part of the StaffEducationOrgEmploymentAssociationExtension complex type collected in PEIMS Submission 1.

Professional and paraprofessional staff may also be reported with an Auxiliary Role ID if they serve the LEA in a non-professional or non-paraprofessional role. A classroom teacher (Role ID 087) who also drives a bus route for the school would require an Auxiliary Role ID to be reported. In this case, the employee would have at least two payroll accounting entries: one with object code 6119, and one with object code 6129. Because there may be duplication between Role ID and Auxiliary Role ID, the LEA must use its discretion in determining if the employee is serving in a professional or non-professional capacity.

❏ Under Paraprofessional Certification:

| Para Cert | Select to indicate that the paraprofessional employee is certified. This field must be selected if the responsibility is 033 - Educational Aide and the population served is 06 - Special Education students. |

|---|---|

| Begin Date | Type the effective date of the employee's paraprofessional certification in the MM-DD-YYYY format, or select a date from the calendar. This date is required if the Para Cert checkbox is selected or changed. |

| End Date | Type the end date of the employee's paraprofessional certification in the MM-DD-YYYY format, or select a date from the calendar. |

❏ Click Save.

Notes:

- The Estimated Annual Salary (Hourly Employees Only) (pay type 3) section was removed from this page. For hourly employees, use the Payroll > Maintenance > Staff Job/Pay Data > Job Info tab to update contract totals with a zero balance for reporting purposes.

- The Unemployment Eligibility section was removed from this page. Use the Payroll > Maintenance > Staff Job/Pay Data > Pay Info tab to update unemployment eligibility.

Pay Info

This tab is used to maintain a range of codes and values to identify and describe an employee's pay information. This record includes pay status, TRS information, FICA, business allowances, federal tax information, and contract totals.

Sample Staff Job/Pay Data Images by Pay Type (prints separately)

The following fields are required:

- Pay Campus

- TRS Status code

- Health Insurance Code

Although all of the fields on this tab are not required, some of the fields are used for reporting to TEA, TRS, IRS, and SSA.

Complete the necessary pay information fields.

Note: If changes are made to the W-4 Withholding Certificate, Tax Exempt, or FSP Staff Salary Data fields in a current year pay frequency, a message is displayed prompting you to allow the same updates in the next year pay frequency, and vice versa. For example, if you made changes in pay frequency 5-Semimonthly CYR and you clicked Yes to allow the changes, those changes are updated in pay frequency E-Semimonthly NYR.

| Field | Description |

|---|---|

| Pay Status | Click  to select the code indicating whether an employee is active or inactive for payroll calculation purposes. to select the code indicating whether an employee is active or inactive for payroll calculation purposes. |

| Pay Campus | Click  to select the employee's pay campus. This is the campus that employs and pays the employee and distributes their paycheck if they receive a physical check. This field is required. to select the employee's pay campus. This is the campus that employs and pays the employee and distributes their paycheck if they receive a physical check. This field is required. |

| Pay Dept | Type the code used by the LEA to further categorize the employee. |

| Dock Rate | Type the standard dock rate to be used if not using the daily rate. This is the rate used when the employee has a leave transmittal that is causing a dock and the Dock Type is set to A- Alternate rate for the transmittal leave type on the Tables > Leave > Leave Rates tab. |

| Tax Exempt | Select if the employee's salary is exempt from taxes. If selected, the W-4 Withholding Certificate fields are disabled. |

| Unemployment Elig |

Select if the employee is eligible for unemployment insurance.

Notes: |

| FICA Eligibility | Click  to select the code indicating the employee's eligibility for FICA/Medicare. to select the code indicating the employee's eligibility for FICA/Medicare.

• M Subject to medicare Review the FICA/Medicare - Quick Reference page for additional details. |

| W4 Marital Status | This field was disabled as of 12/31/2019.

Click |

| Nbr of Exemptions | This field was disabled as of 12/31/2019.

Type a two-digit number of exemptions claimed by the employee for federal income tax withholding. If 99 is entered, no tax is calculated; however, withholding gross is accumulated. |

| IRS Lock-In Letter | Select this field to indicate that the IRS has determined that this employee does not have sufficient withholding and has issued a Lock-in Letter to restrict changes to the employee's W-4 information. Note: This field is shared across all pay frequencies where the employee exists; therefore, changes to the logged-on pay frequency are effective in any other pay frequency and vice versa. If selected:

For more information about the IRS Lock-in Letter, visit https://www.irsvideos.gov/Individual/Resources/WhatsALock-InLetter. |

❏ Under W-4 Withholding Certificate, indicate the employee's W-4 withholding details. If Tax Exempt is selected, these fields are disabled.

Refer to the IRS W-4 Instructions for complete details about completing the following fields. Also, be sure to review Publication 15-T Federal Income Tax Withholding, which contains the withholding tax calculations and the FAQs on the 2020 Form W-4 page, which contains helpful information.

❏ Under TRS:

IMPORTANT: In order for the retiree pension surcharge to apply to an employee, the Status field must be set to 4 or 5, and Take Retiree Surcharge on the Employment Info page must be selected. (In the next year pay frequency, NY Take Retiree Surcharge should be selected for the retiree pension surcharge to apply to an employee.)

| Begin Date | Type the date the employee started contributing to TRS in the MM-DD-YYYY format. Be sure to log on to the TRS Reporting Entity Portal to verify the employee's information. New Member Fee Information: If the employee has satisfied the 90-day New Member requirement per the TRS Portal, the LEA should determine and enter a date outside of the 90-day period to prevent the new member Employer TRS Contribution from being calculated. For example, some LEAs may use the earliest date from the employee's service record. |

|---|---|

| End 90 Day Period | Type the end date of the 90-day waiting period in the MM-DD-YYYY format. This field is populated by the system if:

Pay Status = 1 - Active Note: The End 90-day Period Date no longer has to be blank in order for the End 90 Day Period link to function.

Click End 90 Day Period to calculate the end date of the 90-day waiting period. |

❏ Under FSP Staff Salary Data:

❏ Under Totals, the following fields contain display-only data:

| State Min. Salary | The minimum salary assigned to the employee is displayed as entered in the State Min Salary field under State Info on the Job Info tab. |

|---|---|

| Extra Duty | The total dollar value of all S-type extra duty assignments for the employee is displayed under Extra Duty Pay on the Pay Info tab. |

| Contract Amt | The total amount of pay due to the employee during the current contract period is displayed as entered in the Total field under Contract Info on the Job Info tab. This amount includes the total gross salary and all G-type extra duty assignments. |

| Contract Balance | The total amount remaining to be paid to the employee during the current contract period is displayed as entered in the Balance field under Contract Info on the Job Info tab. |

Extra duty account type detail

The extra duty information is maintained on the Personnel > Tables > Salaries > Extra Duty tab.

❏ Under Extra Duty Pay:

❏ Click +Add to add a row.

❏ Click Refresh Type/Amount to update the Amount field with the amount in the table associated with the selected extra duty pay code.

Notes:

Extra duty pay codes that are account type “S - Supplemental pay” must be manually added to the Distributions tab as “XTRA - Extra Duty” job codes. Extra duty pay codes that are account type “G - Standard Gross pay” must have the job amount manually added to the Job Info tab, Contract Info Total field for one of the non-XTRA jobs assigned to the employee. The distributions also need to be added or adjusted manually. Remaining balances for extra duty jobs that are account type “S - Supplemental pay” will be paid off when the primary job is in contract payoff.

Extra duty pay totals include B (Non-TRS taxable business allowances), G (Standard gross pay), S (Supplemental pay), and T (Non-TRS non-taxable business allowances) type accounts.

The bank information is maintained on the Payroll > Tables > Bank Codes > Bank Codes tab.

For security purposes, any updates saved to the employee's bank information will generate an email to the employee notifying them of the change. The email is sent to the employee's Work and/or Home E-mail address listed on the Personnel > Maintenance > Staff Demo > Demographic Information page. If both email addresses are populated, the email will be sent to both emails. If an email is not available, then the employee will not receive an email.

❏ Under Bank Info:

❏ Click +Add to add a row. Employees can designate from which accounts their net pay is to be distributed. Multiple entries can be made.

❏ Click Save.

A message is displayed prompting you to update bank records to next year.

- Click Yes to copy the records to next year.

- Click No to continue without copying the record to next year.

Job Info

This tab is used to maintain a wide range of information about the one or many jobs the employee may be assigned. This data includes calendar data, contract information, accrual information, and specifics about the employee's salary pertaining to each job.

Sample Staff Job/Pay Data Images by Pay Type (prints separately)

The following fields are required:

- Job Code (from a local-defined table; 9999 is the default)

- Primary (must be selected for one job code)

- % Assigned (multiple jobs should equal 100%)

- Primary Campus (table-defined code)

- Pay Type (1 for professional staff (exempt) and 2 for auxiliary or paraprofessional staff. If set to 3 or 4, account distribution is not required.)

- TRS Member Pos

- Begin Date

- End Date

If the contract Total (salary) field is populated, the Distributions tab must be completed before the record can be saved.

Although all of the fields on this tab are not required, some of the fields are used for reporting to TEA, TRS, IRS, and SSA.

Complete the necessary job information fields.

❏ Click +Add to add a row.

| Field | Description |

|---|---|

| Job Code | Type the four-digit job code to which the employee is assigned, or click  to select a job code from the Job Codes list. to select a job code from the Job Codes list.Job codes are maintained on the Personnel > Tables > Job/Contract > Job Codes tab. |

| Primary | Select if this is the employee's primary job. An employee may only have one primary job. |

| % Assigned | Type the number which indicates the total percentage of the employee’s responsibilities represented by the job entered. For example, if the job represents half of his total assignment, type 50. Note: If the employee has multiple jobs, it is your responsibility to ensure that the job percent assigned is accurate based on the total contract amounts for all jobs, excluding XTRA-coded jobs. The percent assigned is used when distributing absence deductions and refunds across jobs and in next year budget calculations. |

| Pay Type | Refer to the Quick Reference by Pay Type document for more information on pay types. If the LEA does not use Position Management, the Pay Type field is enabled. If the LEA uses Position Management and Using PMIS is selected on the District Administration > Options > Position Management page, then the Pay Type field is disabled. If a new job record is added, the Pay Type field default is 4. The Pay Type field is provided by PMIS when data is moved from PMIS to payroll. |

| Primary Campus | Click  to select the primary campus for the job code. This is the campus where the employee performs the selected job. If an employee has multiple jobs, they may have multiple primary campuses depending on where each specific job is being performed. to select the primary campus for the job code. This is the campus where the employee performs the selected job. If an employee has multiple jobs, they may have multiple primary campuses depending on where each specific job is being performed.The primary campus is not the pay campus. This field is used for informational and reporting purposes. |

| Dept | Type the code used by the LEA to further categorize the employee. The field can be a single digit. |

❏ Under Contract Info:

| Pay Type |

PEIMS Reporting Element

Pay type 1 employees are generally those employees that are under contract such as superintendents, principals, instructors, etc. (exempt employees under FLSA) whose pay rate remains constant over the course of their contract.

Notes: |

|---|---|

| Pay Grade | Click  to select the pay grade at which the employee is paid. The field is used to identify the correct salary amount on the salary table. to select the pay grade at which the employee is paid. The field is used to identify the correct salary amount on the salary table.Pay grades are maintained on the Personnel > Tables > Salaries > Local Annual and Hourly/Daily tabs. |

| Pay Step | Click  to select the pay step at which the employee is paid. The field is used to identify the correct salary amount on the salary table. to select the pay step at which the employee is paid. The field is used to identify the correct salary amount on the salary table. |

| Sched | Click  to select the local subschedule of the employee’s pay grade and step. The field is used to identify the correct salary amount on the salary table. to select the local subschedule of the employee’s pay grade and step. The field is used to identify the correct salary amount on the salary table. |

| Max Days |

Type the number of contract days which relate to the correct salary on the salary table. Note: If Use PMIS is selected on the District Administration > Options > Position Management page, the Max Days field is enabled. |

| Hrs Per Day | Type the standard number of hours per day to be worked by the employee. The field is disabled for all XTRA coded jobs and is calculated automatically for pay type 2 employees when you click Calculate. The field is used exclusively by a timekeeping system when the Merge Payroll Transactions Files is used and regular hours exist in the import file. Note: For pay type 3 employees, the Hours field on the Midpoint Salary table must be populated. Data from the Hours field on the Midpoint table populates the Hrs/Day field on the Job Info page. The Hrs/Day field can be modified on the Job Info tab, if necessary. |

| Incr Pay Step | Select if the employee is eligible for an incremental pay step. |

| Total | Type the contract amount for each of the employee's job codes. Extra duty pay codes that are account type “G - Standard Gross pay” must have the job amount manually updated in the Contract Total field. |

| Balance | Type the total amount remaining to be paid to the employee during the current contract period. |

| # of Annual Pymts | Type the total number of annual payments due the employee. This number may differ from the contract months when an employee is on a 10-month contract but receives 12 monthly checks. |

| Remaining Pymts | Type the number of payments remaining to be made to the employee during the current contract period. |

| Concept | This field is display only and identifies the salary table used to compute the employee’s salary (e.g., local annual, hourly/daily, or midpoint). |

| # of Months in Contract | Type the total number of months the employee is scheduled to work. |

| Stat Min Days |

Click

• 000 TRS - Non contract

Note: Classroom teachers, full-time librarians, full-time counselors, and full-time registered nurses are always set to 187 - Valid basic days in contract, regardless of the actual days in the contract. |

| Base Annual | This field is display only. The field is calculated based on the salary concept associated with the job and pay grade, step, schedule, and maximum days when entered. |

| Daily Rate | Type the gross amount of pay due the employee on a per-day basis. The rate is computed by dividing the base annual pay by the number of days employed. If you selected to automatically compute the daily rate in District HR Options, the field is display only and the system computes the value. |

| Contract Total | The amount from the Total field is displayed. The contract total = daily rate (salary schedule) x # of Days Empld. This field is used for the employee's annual salary amount and is reported to TEA. |

| # of Days Empld | The number of days employed is calculated based on the contract begin and end dates. The # of Days Empld hyperlink recalculates the number of days based on the calendar. If the calendar code is blank, the hyperlink is not available and the field is enabled for changes. |

| # Days Off | Type the number of days that the employee is eligible to take off. This information is used for Position Management. |

| Vacant Job | Select if the job is currently not filled. This option is only enabled when using Position Management. |

| Pay Rate | Type the gross amount of pay due to the employee per pay period. The rate is computed by dividing the contract amount by the number of annual payments. If you selected to automatically compute the pay rate in District HR Options, this field is display only, and the system computes the value. This field is required if the Pay Type field is set to 3 (hourly employee). |

| # Annual Pymts | The value from the # of Annual Pymts field is displayed. |

| Payoff Date | Type the date on which the employee's contract is paid off in the MMDDYYYY format. When this date and the pay date match, contract payoff occurs. |

❏ Click Calculate to display the Employee Salary Calculation pop-up window.

❏ Under Type of Calculation:

❏ Select Salary to run the regular salary calculation or select State Minimum Only to only run the state minimum calculation.

| Apply Percent of Day Employed to Salary Amount | Select to calculate the salary for either the Salary or the State Minimum Only option based on the percentage of day employed. |

|---|

❏ Click Execute to start the recalculation process or Cancel to close the page without recalculating.

The State Step is needed for a contract employee unless they are retired from TRS. The Position Code and % Assigned are used to calculate the State Min Salary.

Notes:

The Calculate button only calculates the selected job. If the employee has multiple jobs, each job needs to be selected and calculated.

The Calculate button only calculates a salary if a salary scale is built in the tables and all applicable fields are completed. For example, G-type extra duties are not tied to a salary table; therefore, cannot be added to the contract total.

If Use PMIS is selected on the District Administration > Options > Position Management page, the Calculate button is disabled.

CAUTION: When calculating a midpoint salary, if the LEA has selected the Amount option in the Distributions Built by Amt or % field of the HR Options table, the system requires that a distribution amount be greater than zero and is not saved until an amount is entered for a new employee or an employee with a salary change. Since the system is not saved with zero amounts the user has to enter an amount manually. When a manual amount is entered into the distribution amount and contract balance and the user clicks Calculate, the amounts are not changed or updated. Since midpoint has no steps, the assumption is that the employee remains at that salary level without regard to whether the employee is within the minimum or maximum ranges.

When calculating a midpoint salary, if the district has selected the Percentage option in the Distributions Built by Amt or % field of the HR Options table, the program saves zero as an amount in distribution and contract balance allowing the percent to equal 100%. When saved without a distribution amount and a contract amount, and the user clicks Calculate, the system populates these fields automatically with amounts from the Midpoint salary table.

❏ Under State Info:

The Personnel > Tables > Salaries > State Minimum tab must be completed in order to populate state minimum calculations.

| State Step | Type the state step that the employee has earned based on years of service. State step does not include Career Ladder. ASCENDER does not support Career Ladder as it is no longer required. |

|---|---|

| Yrs in Career Ladder | Type the code identifying the current career ladder level for an employee. The field can be a single digit. |

| TRS Year | Select to indicate those employees whose contract year begins in July or August (nonstandard) and who receive a contract payment before the beginning of the school year. If TRS Year is selected, the payroll calculation program determines if a new school year record should be created when updating the Nbr Days Earned field, and accrual amounts for those July and August employees. Example: An employee accrues and has a 12-month contract with the first payment in July; therefore, the actual salary and benefit amounts update the current school year, and the Nbr Days Earned, accrual salary, and benefits update the new school year. When the next school year begins, the amounts accrued are available for use during the next school year. Notes: The beginning of the school year is determined by when the majority of the employees are paid, which is normally September. Do not select TRS Year if the employee accrues and the contract begins during any month other than July and August. Otherwise, an incorrect school year is created, which affects the accrued salary and benefits. If the employee does not accrue, TRS Year does not have an adverse effect on the creation of a school year record. |

| TRS Member Pos | Required TRS reporting field.

Click

• 01 - Professional staff

Notes: A value must be selected in the TRS Member Pos field and the contract begin date must be less than or equal to the current month when extracting the Contract and Position (ED40) report for the first time (i.e., First Time Report ED40 is selected.) The TRS Member Pos field must be set to 01, 02, or 05 if the value in the State Min Salary field is greater than zero. |

| Wholly Sep Amt |

Type the total annual salary that is not subject to the State Base. This field should only be used if part of the contract total includes a wholly separate amount.

Example: This field is used in computing the monthly amounts not subject to above state base salary calculations (TRS 373). The wholly separate amount reduces TRS gross wages for TRS 373 calculations. |

| State Min Salary | The salary is computed by multiplying the foundation daily rate by the percent assigned times the number of days in the contract. The value is automatically computed when an employee record is selected, but may be overwritten. |

| Foundation Daily Rate | This field displays the rate from the State Minimum Salaries table. |

| % Assigned | Enter up to 100% assigned. |

| # of Days Emplyd |

This field displays a value based on the following: |

| Retiree Exception | Click  to select the applicable retiree exception code. This field is used along with the Employment Type and Take Retiree Surcharge fields to determine whether or not to calculate a retiree surcharge for an employee. A value cannot be saved if the employee's TRS Status is set to 1 Eligible on the Pay Info tab. This field is disabled for XTRA jobs. to select the applicable retiree exception code. This field is used along with the Employment Type and Take Retiree Surcharge fields to determine whether or not to calculate a retiree surcharge for an employee. A value cannot be saved if the employee's TRS Status is set to 1 Eligible on the Pay Info tab. This field is disabled for XTRA jobs.

• E Surge Personnel

|

❏ Under Calendar/Local Info:

| Calendar Cd | Type the calendar code, or click  to select the two-digit code identifying the calendar for the employee. The calendar indicates the dates of the employee’s work days and holidays. This field relates to the School Calendar table built with the holidays, in-service days, and work days for various LEA employees. to select the two-digit code identifying the calendar for the employee. The calendar indicates the dates of the employee’s work days and holidays. This field relates to the School Calendar table built with the holidays, in-service days, and work days for various LEA employees. |

|---|---|

| Begin Date | Required TRS reporting field. This field is automatically populated based on the selected calendar. If a calendar is not selected, type the beginning date for the calendar in the MMDDYYYY format. This field is required for all pay types. |

| End Date | Required TRS reporting field. This field is automatically populated based on the selected calendar. If a calendar is not selected, type the ending date for the calendar in the MMDDYYYY format. This field is required for all pay types. |

| # of Days Empld | PEIMS Reporting Element Type the actual number of at-work days within the school year the employee is scheduled to work in the LEA for the selected calendar. This number does not include holidays, weekends, and any other days the employee is not scheduled to work. If an employee does not work the same amount of days as shown on the contract (e.g., the person does not begin work at the start of the school year), the actual number of days the employee will work must be reported. If a workday calendar is set up on Tables > Workday Calendars, the field is set according to the selected calendar. If a calendar is not set up, the field is determined by the Begin Date and End Date fields on the Job Info tab, or can be manually entered. |

| Exclude Days for TEA | Select to exclude the number of days employed (for the selected job) from TEA reporting. For example, this field would be used for an employee who performs two separate jobs on the same day. Example: If an employee's primary job is as a teacher but they also assist in driving a bus, the bus driving job is an additional and separate job. Because it is a separate job and the days have been reported to TRS from the teaching record, the Exclude Days for TEA checkbox can be selected for the bus driving job. |

| Years Job Exp | Type the number of years of job experience the employee has for the selected job. The field can be a maximum of two digits. This is a local-use field. |

| Local Contract Days | Type the number of days an employee is required to work in the selected job in order to meet district contract requirements. The field can be a maximum of three digits, is user-defined, is not used in calculations, and can be updated on the Utilities > Mass Update page. This field is displayed on the HRS1650 - Employee Salary Information and User Created reports. This is a local-use field. |

❏ Under Worker's Comp Info:

Note: If the workers’ compensation code is changed, the code is also changed for the distribution records associated to the job. If the distribution records are types B, T, or G with extra duty codes, the distribution WC code is only changed if the original workers’ compensation codes in the job record and the distribution records matched before the job record was changed.

Calculating Workers' Compensation

| WC Ann Pymts | Type the number of annual workers' compensation payments for the contract period. |

|---|---|

| WC Remain | Type the number of remaining workers' compensation payments to be made during the contract period. |

Note: The number of months in the contract should correlate with the number of workers' compensation payments. For example, if the employee has a 10-month contract, then the employee will have ten workers' compensation payments and ten workers' compensation remaining payments at the beginning of the school year. The WC Remain field is decreased by one with each regular processed payroll until it is zero. Workers' Compensation is only calculated during the months in which the employee is actually working. The above two fields and the Workers' Compensation Code field are required for expensing to occur when a payroll is processed.

❏ Under Accrual Info:

| Code | Click  to select the one-character, LEA-defined code required if the LEA is using the accrual pay special option. The code must match a code used to identify a calendar on the Accrual Calendar tab. If an accrual code is entered, it applies to the current job. Each job can have a different number of days earned per processed pay date; therefore, can be assigned a different accrual code. to select the one-character, LEA-defined code required if the LEA is using the accrual pay special option. The code must match a code used to identify a calendar on the Accrual Calendar tab. If an accrual code is entered, it applies to the current job. Each job can have a different number of days earned per processed pay date; therefore, can be assigned a different accrual code. |

|---|---|

| Accrual Rate | Type the rate which is the annual contract amount divided by the number of days employed. If you selected to compute the accrual rate automatically in District HR Options, the field is display only, and the system computes the value. |

| Total | Displays the amount from the Contract Info Total field. |

| # of Days Empld | PEIMS Reporting Element Displays the value from the Calendar Info # of Days Empld field. |

Note: A distribution must be added on the Distributions tab prior to clicking Save.

❏ Click Save.

Distributions

This tab links budget codes, pay amounts (and percentages), and grant codes to activity codes, which indicate specific job responsibilities. The tab serves to identify the specific sources of the funds used to cover an employee's total salary. The tab also shows how the employee's salary is distributed. Before using this tab, ensure that each employee has a demographic record as created using the Maintenance > Staff Demo > Demographic Information tab.

Sample Staff Job/Pay Data Images by Pay Type (prints separately)

Complete the necessary distribution information fields.

❏ Click +Add to add a row.

| Field | Description |

|---|---|

| Job Code |

Click Note: All distributions for a particular job code and account type are totaled together. Any new type G distributions are totaled with the regular type G distributions. The total contract amount is applied to these distributions. |

| Extra Duty Code |

Click

Notes: |

| Account Type |

Click Note: All distributions for a particular job code and account type are totaled together. Any new type G distributions are totaled with the regular type G distributions. |

| Account Code |

Type the account code, or click Note: When the user is logged on to the current payroll files, the account code validation occurs against the Finance Chart of Accounts. If the user is logged on to the next year payroll files, the account code must exist in the Budget > Maintenance > Budget Data tables. |

| Description | Displays the description associated with the account code from the Finance chart of accounts. |

| Amount | Type the dollar value to be expended from the budget code. Type all or part of the contract total from the Job Info tab. If the Distributions Built By Amt or % field on the District HR Options page is set to Percentage, then only the Percentage field is enabled for use. For a salaried (pay type 1 or 2) employee, the data in this field is used to calculate the percent amount.

Notes: |

| Percent |

Type what percentage of the total pay rate is represented by the amount indicated. The percentage is the portion of contract total from the Job Info tab. If the Distributions Built By Amt or % field on the District HR Options page is set to Amount, then only the Amount field is enabled for use. This field is calculated by the system for salaried (pay type codes 1 and 2) employees. |

| Activity Code | Click  to select the two-digit code identifying the activity for which the employee is receiving pay according to the budget code and amount indicated. This is a required TEA PEIMS Pay Activity code. (78 Non-Salary is for $0 pay). For extra duty accounts, the Activity Code field is populated from the Personnel > Tables > Salaries > Extra Duty tab. to select the two-digit code identifying the activity for which the employee is receiving pay according to the budget code and amount indicated. This is a required TEA PEIMS Pay Activity code. (78 Non-Salary is for $0 pay). For extra duty accounts, the Activity Code field is populated from the Personnel > Tables > Salaries > Extra Duty tab. |

| TRS Grant Code | This field is populated automatically for active employees based on the grant code associated with the fund as defined on the Tables > Salaries > Fund to Grant tab. |

| Worker's Comp Code | Click  to select the workers' compensation code (e.g., A, B), or leave blank if the distribution is not subject to workers' compensation taxes. This field is only enabled if the Extra Duty Code field is populated. to select the workers' compensation code (e.g., A, B), or leave blank if the distribution is not subject to workers' compensation taxes. This field is only enabled if the Extra Duty Code field is populated. |

| Expense 373 |

Click

Notes: |

| Employer Contribution | Select if the distribution should be included as an employer insurance contribution. The field is only available when account type G is selected. This is used to expense employee benefits such as the employer insurance contribution. |

| Performance Pay | Select if the amount to be paid for this account should be included in the TRS deposits performance pay calculations. The field is only available for account types G or S. This is for TRS Certified (TRS 596) performance compensation. |

❏ Click Re-sort. The records on the tab are sorted by job code, account type, and extra duty code.

❏ Click Refresh Totals to update the totals if new percentages or amounts are added.

❏ Click Save.

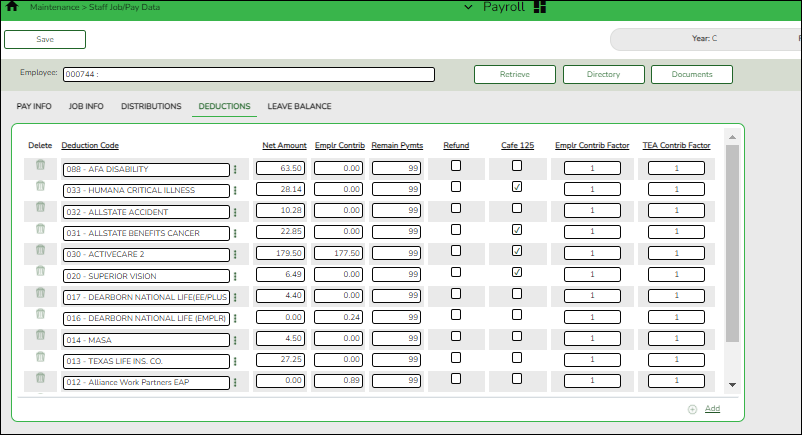

Deductions

This tab is used to identify specific deductions that apply to an employee's pay. Deduction data includes the deduction code/description, the net amount to be deducted, an indication of a cafeteria-125 deduction, the number of remaining payments, and the employer's contribution.

Reminder: Be sure to verify the accuracy of deduction information for returning employees.

Predefined abbreviated deduction codes

Predefined Abbreviated Deduction Codes

| Abbreviated Code | Description | Object Code | W-2 Box | W-2 Code |

|---|---|---|---|---|

| A3 | 403b FICA Annuity (FICA Alternative) | 2159 | ||

| AC | TRS Health Insurance | 2153 | 12 14 | DD HEALTH |

| AN | Annuities | 2159 | 12 | E |

| CU | Credit union | 2154 | ||

| D1 | 457 deferred comp | 2159 | 12 | G |

| D2 | 457 deferred comp lump amount | 2159 | 12 | G |

| DC | Dependent child care | 2159 | 10 | |

| HI | Health insurance | 2153 | 14 | HEALTH |

| HS | Health savings account | 2159 | 12 | W |

| IR | Income replacement | 2159 | ||

| LI | Life insurance | 2153 | ||

| M1 | Miscellaneous 1 | 2159 | ||

| M2 | Miscellaneous 2 | 2159 | ||

| M3 | Miscellaneous 3 | 2159 | ||

| R1 | Roth 403b Annuities | 2159 | 12 | BB |

| R2 | Roth 457b Annuities | 2159 | 12 | EE |

| RI | Retiree TRS-Care surcharge | 2155 | ||

| SB | Savings bond | 2159 | ||

| TC | Emplr contrib to whole life ins | 2153 | 12 | C |

| TI | Emplr contrib group ins over $50,000 | 2153 | ||

| TR | TRS service buy back | 2159 | ||

| TS | TSTA dues | 2159 | ||

| UD | Union dues | 2159 | ||

| UF | United fund | 2159 | ||

| WH | Additional withholding | 2151 | 2 |

Complete the necessary deduction information fields.

❏ Click +Add to add a row.

❏ Click Save. A message is displayed that asks if you would like to update deduction records to next year.

- Click Yes to copy the records to next year.

- Click No to continue without copying the record to next year.

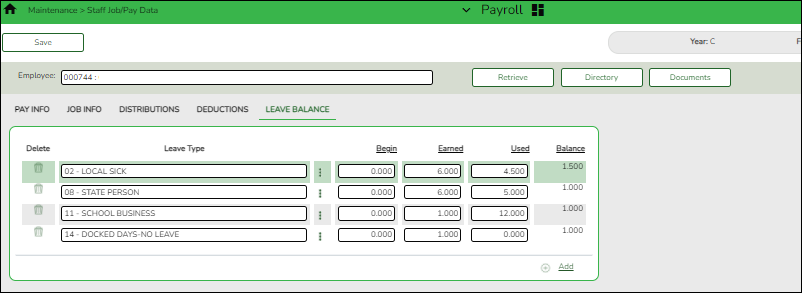

Leave Balance

This tab is used to maintain the status of each type of leave which applies to a given employee. These categories include updated totals for leave earned and leave used, and a leave balance for the various kinds of leave, both state and local.

Leave information is maintained on the Payroll > Tables > Leave page and must be updated prior to using this tab.

Note: The tab is available for maintenance of the current year leave balance only. The tab is not accessible when in the next year frequency.

Reminder: Be sure to verify the accuracy of leave information for returning employees.

Complete the necessary leave balance fields.

❏ Click +Add to add a row.

❏ Click Save.

Americans with Disabilities Act (ADA) and Web Accessibility

The Texas Computer Cooperative (TCC) is committed to making its websites accessible to all users. It is TCC policy to ensure that new and updated content complies with Web Content Accessibility Guidelines (WCAG) 2.0 Level AA. We welcome comments and suggestions to improve the accessibility of our websites. If the format of any material on our website interferes with your ability to access the information, use this form to leave a comment about the accessibility of our website.