ASCENDER - NYR Payroll Process Quick Checklist

This checklist provides a quick at-a-glance view of the steps listed in the complete ASCENDER - Next Year Payroll Process guide. You can click the step link to open additional information about the step (as it is displayed in the complete guide).

The NYR Payroll Process Quick Checklist guides you through the necessary steps to create next year's payroll. This process includes updating tables and employee information, calculating salaries, performing edits, and interfacing payroll to Budget. This process occurs in the next year and does not interfere with the current year processing.

This document assumes you are familiar with the basic features of the ASCENDER Business system and have reviewed the ASCENDER Business Overview guide.

Created: 02/01/2024

Reviewed: 03/01/2024

Revised: 03/01/2024

Prerequisites

Before You Begin

NYR Payroll Process Quick Checklist

| Task | Reference the Step in NYR Payroll Process Guide | |

|---|---|---|

Update Payroll Current Pay Frequency |

||

| ❏ | Finance > Inquiry > General Ledger Inquiry > General Ledger Inquiry Verify August EOY payroll accruals. | Step 1 |

| ❏ | Payroll > Next Year > Copy CYR Tables to NYR > Clear Next Year Tables Clear all next year (NYR) tables. | Step 2 |

| ❏ | Payroll > Next Year > Copy CYR Tables to NYR > Copy Current Year Tables Copy all current year (CYR) tables to next year (NYR). | Step 3 |

| ❏ |

Payroll > Next Year > Copy CYR Staff to NYR Copy the employees from the current year payroll to the next year payroll. If you have multiple pay frequencies, complete this task in all pay frequencies.

• Under Pay Status, select Active to copy only active employees.

| Step 4 |

| ❏ | Verify employee data using various reports. | Step 5 |

Update Personnel |

||

| ❏ | Personnel > Tables > Credential Update Credential tabs as needed. Note: The Teaching Specialization tab is used to report Pre-K teachers for Class Roster so if there have been changes, you can make those updates now in anticipation of the submission. | Step 6 |

| ❏ |

Personnel > Tables > Salaries NYR

• Local Annual - This tab is the most commonly used. You can make mass updates by percent or dollar amount, or by employee. To see a change before saving the record, enter the change and click Default. The original annual amount is displayed in the Annual Amt column, the percent or dollar is increased, and the New Amount is displayed. Click Save. If decreasing a salary, enter a negative percent or dollar amount.

| Step 7 |

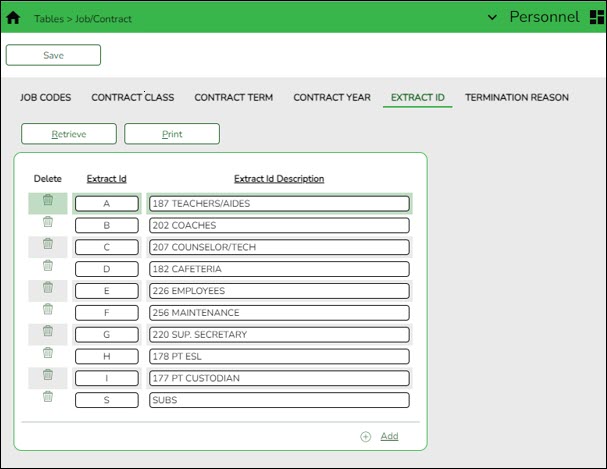

| ❏ | Personnel > Tables > Job/Contract > Job Codes NYR Add or update job codes as needed. Note: You can assign accrual codes, Workers’ Comp codes, and FTE hours to lessen the workload when completing tabs for new employees. | Step 8 |

| ❏ |

Personnel > Tables > Workday Calendars

• Calendars tied to a numeric frequency (e.g., 6) are used for current year.

| Step 9 |

| ❏ | Personnel > Maintenance > Staff Demo > Demographic Update staff demographic data. | Step 10 |

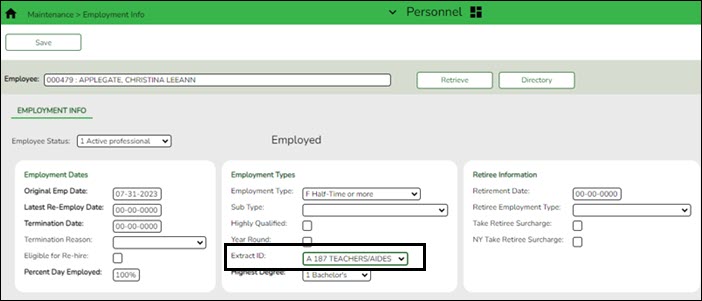

| ❏ | Personnel > Maintenance > Employment Info Review retirees and verify that NY Take Retiree Surcharge is selected in order to include the retiree surcharge when the Extract Payroll to Budget process is performed. Review and update terminated employees. It is best practice to not only update the Termination Date and Reason but, if applicable, update the Auxiliary Role ID and Paraprofessional Certification End Date. Also, update the End Date on the employee's responsibility record. | Step 11 |

Update Payroll Next Year Pay Frequency |

||

| ❏ |

Payroll > Tables > Tax/Deductions Update the following tabs as needed.

• FICA Tax - This tab is used to copy rates from the current calendar year to next calendar year.

| Step 12 |

| ❏ |

Payroll > Tables > Accrual Calendars > Accrual Calendar

• Most districts only accrue 10-month employees. If that is true for you, each code should begin with August 31 and show the number of days that group of employees will work in August. Add 12 more lines and enter the true/regular Pay Dates. Enter the days employees work in the month associated with each pay date.

| Step 13 |

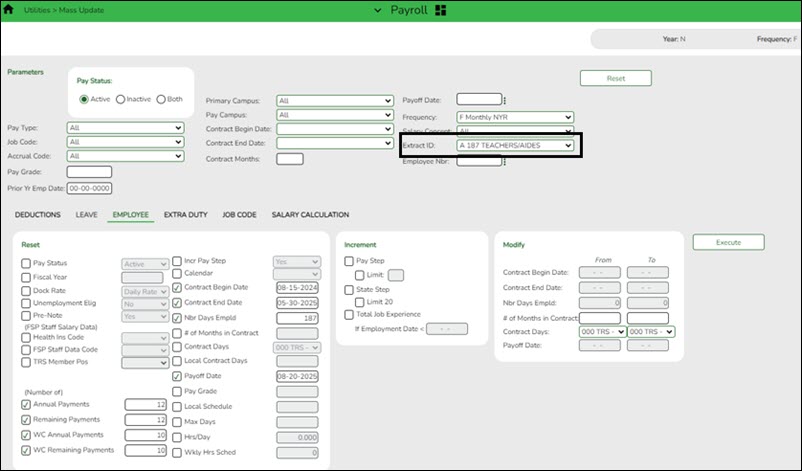

| ❏ | Payroll > Utilities > Mass Update > Deductions If applicable, mass update the Employer Contribution and Remaining Payments for all employees with health care and other employer paid deductions. | Step 14 |

| ❏ |

Payroll > Utilities > Mass Update > Employee Consider repeating this step as follows for each pay type to ensure that all employees are incremented properly.

• For Pay Type 1 (Contracted Employees), increment once for both the Pay Step and State Step.

| Step 15 |

| ❏ |

Payroll > Utilities > Mass Update > Employee

• Fiscal Year - If some employees should not be incremented to the next fiscal year, repeat this step only selecting specific employees and mass update them back to the correct fiscal year. An example of this may include those paid with Elementary and Secondary School Emergency Relief (ESSER) Programs.

| Step 16 |

| ❏ |

Payroll > Utilities > Mass Update > Extra Duty | Step 17 |

| ❏ | Payroll > Utilities > Mass Update > Salary Calculations Perform salary calculations for employees. An error report will provide a list of employees not tied to a salary table. Use this list as a reminder of which employees need to be manually updated. | Step 18 |

| ❏ |

Payroll > Maintenance > Staff Job/Pay Data > Job Info and Distributions Manually add or update salary information for those employees not tied to salary tables. For example, most often, administrators such as the Superintendent or Principal.

• Manually enter an estimated annual salary amount for pay type 3 (Hourly) employees in order to budget for these employees.

| Step 19 |

Verify Accuracy of Data |

||

| ❏ | Verify TRS fields. | Step 20 |

| ❏ | Verify salary calculations. | Step 21 |

| ❏ | Payroll > Utilities > Payroll Simulation > Addendum Verify data using addendum sheets. | Step 22 |

| ❏ | Payroll > Utilities > Pre-Edit Payroll Data Perform “test payroll”. | Step 23 |

| ❏ | Payroll > Utilities > Employee Benefits Interface > Import Annual File Perform staff benefits updates. | Step 24 |

Interface NY Payroll to Budget - These steps can be repeated as often as necessary to update budget data. |

||

| ❏ | Payroll > Next Year > Interface NY Payroll to NY Budget > Extract Payroll Account Codes Work across the tabs to extract next year payroll data. Review the reports and interface to Budget to provide preliminary budget amounts if needed. | Step 25 |

| ❏ | Payroll > Next Year > Interface NY Payroll to NY Budget > Extract Reports Verify the Extract Reports tab. | Step 26 |

| ❏ | (If necessary) Perform another extract and interface to Budget. | Step 27 |

| ❏ | Payroll > Next Year > Interface NY Payroll to NY Budget > Interface to Budget Interface to Budget. | Step 28 |